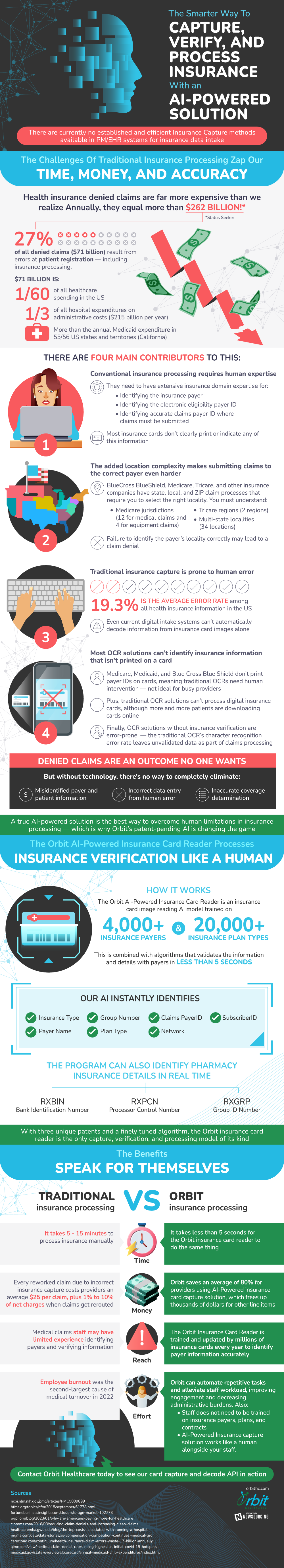

Insurance is a large and consistent source of stress for many Americans. Not only is the monthly cost a big burden, but insurance coming into effect is even more stressful. A hospital bill without insurance simply isn’t affordable to the majority of Americans. Consequently, a denied insurance claim is a nightmare for just about everyone.

The problem is about 30% of denied insurance claims are due to simple human errors. While some are due to mis-inputs, most are due to a lack of expertise. Imagine, for example, the process of submitting insurance information for a claim. Many modern insurance cards simply do not have the full set of information on them. Instead, they require the person submitting the claim to go out of their way to find the full information.

Even with all the information, submitting the claim to the right place represents its own struggle. These factors together make it easy to have unfairly denied insurance claims. This alone can be frustrating but when you factor in the time one took to research the best insurance plan with the best coverage and then it still gets denied it can be even more disheartening. Importantly, these are all human-borne issues, and they can all be solved through technology.

AI-powered card readers, in particular, manage to solve all these issues. They are trained on insurance plans and payers themselves. What this means is that they recognize insurance plans on insurance cards, not just text. This moves the barrier of expertise from the person to the technology, a very efficient process.

These card readers also easily remove any issues with mis-inputs, as any digital card reader does realistically. And finally, these AI card readers can help with submission and processing. All of these factors together make it so that this big percentage of denied claims can be removed. AI-powered card readers aren’t perfect, but they can only get better.

Source: OrbitHC